All Categories

Featured

State Farm representatives sell every little thing from house owners to car, life, and various other prominent insurance items. It's easy for agents to pack services for discounts and easy strategy monitoring. Lots of clients enjoy having actually one trusted agent manage all their insurance policy needs. State Farm supplies universal, survivorship, and joint global life insurance policies.

State Farm life insurance is usually conventional, offering stable choices for the average American family. If you're looking for the wealth-building possibilities of global life, State Ranch lacks affordable alternatives.

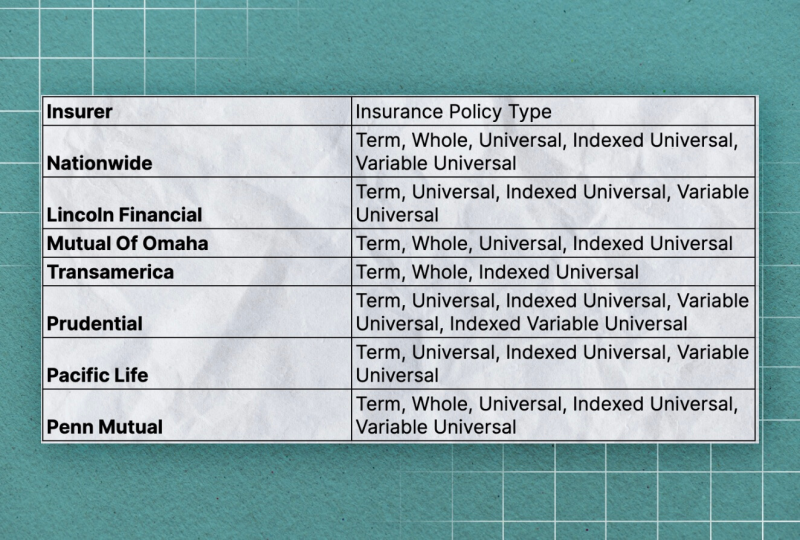

It does not have a solid presence in various other economic items (like universal strategies that open the door for wealth-building). Still, Nationwide life insurance policy strategies are very accessible to American households. The application procedure can also be more workable. It assists interested parties get their means of access with a trusted life insurance policy strategy without the far more complex discussions regarding investments, monetary indices, and so on.

Nationwide fills the essential duty of getting hesitant buyers in the door. Even if the most awful happens and you can't obtain a bigger strategy, having the security of a Nationwide life insurance policy could transform a purchaser's end-of-life experience. Review our Nationwide Life insurance policy testimonial. Insurer utilize medical examinations to assess your threat class when obtaining life insurance policy.

Purchasers have the option to alter rates each month based on life situations. Of program, MassMutual provides interesting and possibly fast-growing possibilities. These plans often tend to carry out best in the lengthy run when early down payments are greater. A MassMutual life insurance policy representative or monetary expert can aid buyers make strategies with area for modifications to satisfy temporary and long-lasting monetary goals.

Index Universal Life Vs Whole Life

Read our MassMutual life insurance policy review. USAA Life Insurance Coverage is recognized for supplying affordable and thorough monetary products to armed forces members. Some purchasers might be surprised that it provides its life insurance coverage policies to the basic public. Still, armed forces members appreciate special advantages. Your USAA policy comes with a Life Occasion Choice rider.

VULs come with the highest threat and the most possible gains. If your policy doesn't have a no-lapse warranty, you may even shed coverage if your money worth dips listed below a specific limit. With a lot riding on your financial investments, VULs require continuous focus and upkeep. It may not be a wonderful alternative for individuals that just desire a fatality advantage.

There's a handful of metrics through which you can evaluate an insurance company. The J.D. Power client fulfillment ranking is a great choice if you desire an idea of how consumers like their insurance coverage plan. AM Finest's financial stamina score is another crucial statistics to think about when picking a global life insurance policy company.

This is particularly important, as your money worth expands based on the investment choices that an insurance business supplies. You must see what financial investment alternatives your insurance service provider offers and compare it against the goals you have for your policy. The most effective way to locate life insurance is to gather quotes from as several life insurance policy business as you can to comprehend what you'll pay with each policy.

Latest Posts

Universal Life Guaranteed Rate

Index Insurance Company

7702 Iul